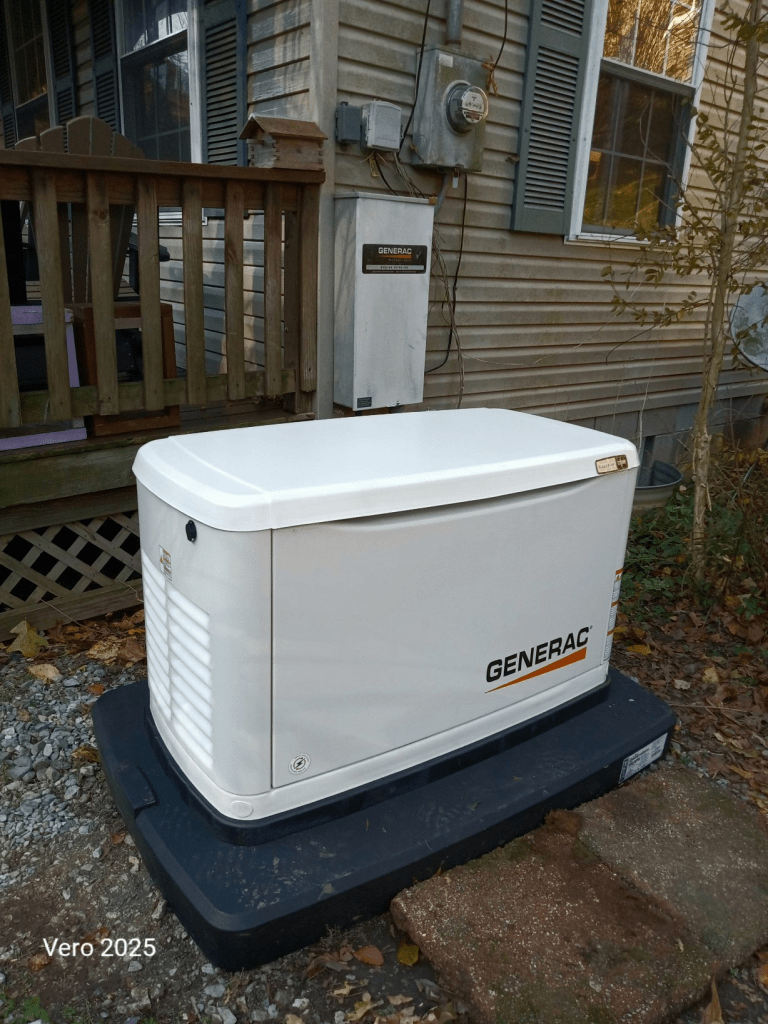

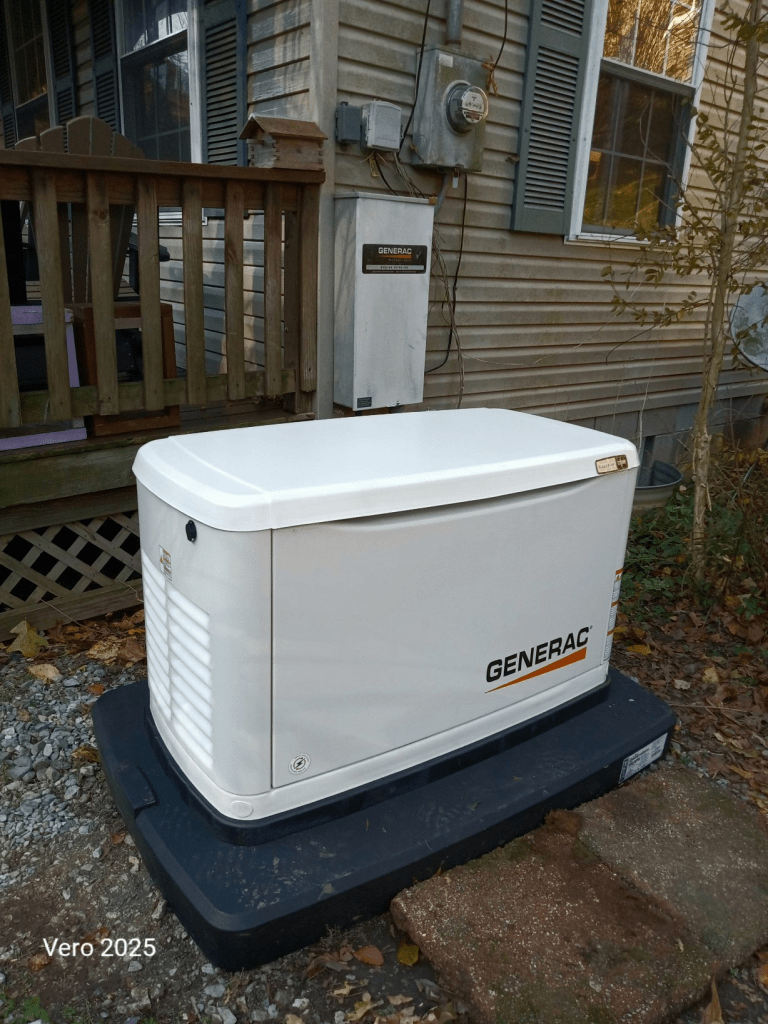

Just a quick post to share a picture of my newest addition.

Finally a generator that will run the A/C in the summertime! Our old one just wasn’t heavy duty enough.

It’s been a busy day!

Just a quick post to share a picture of my newest addition.Finally a generator that will run the A/C in the summertime! Our old one just wasn’t heavy duty enough.It’s been a busy day!

Just a quick post to share a picture of my newest addition.

Finally a generator that will run the A/C in the summertime! Our old one just wasn’t heavy duty enough.

It’s been a busy day!

Week 1: Getting Started with Personal Finance

Lesson Overview

In this first week, you’ll explore what personal finance really means and how small, consistent actions can dramatically improve your financial health. You’ll set clear goals and learn how to track where your money goes each month.

—

Lesson 1.1 — What is Personal Finance?

Key Ideas:

Personal finance is the process of managing your money—how you earn, save, spend, and invest it.

Financial literacy is understanding these principles well enough to make confident decisions.

Managing money effectively gives you control, reduces stress, and builds freedom.

Activity:

Write down one reason why improving your finances matters to you. This will guide your motivation throughout the course.

—

Lesson 1.2 — Setting Financial Goals

Why Goals Matter:

Without clear goals, money tends to slip away unnoticed. Goals help you direct your spending and savings toward what truly matters.

Types of Goals:

Short-term (0–1 year): Build an emergency fund, pay off a small debt.

Medium-term (1–5 years): Save for a vacation, a car, or further education.

Long-term (5+ years): Buy a home, plan for retirement, achieve financial independence.

SMART Goal Framework:

Specific, Measurable, Achievable, Relevant, Time-bound.

Example: “Save $1,000 for an emergency fund in 6 months by saving $170 each month.”

Activity:

Write down one short-term and one long-term financial goal using the SMART format.

—

Lesson 1.3 — Budgeting Basics

Purpose of a Budget:

A budget helps you understand where your money goes and ensures you’re spending intentionally—not impulsively.

Steps to Create a Simple Budget:

1. List your income: Include all sources (job, side hustles, etc.).

2. Track your expenses: Use a notebook or an app to record daily spending.

3. Categorize spending: Needs (rent, food) vs. Wants (entertainment, dining out).

4. Set limits: Decide how much to spend per category.

5. Review regularly: Adjust monthly as your situation changes.

Popular Budgeting Methods:

50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt.

Zero-Based Budget: Every dollar has a job—income minus expenses = 0.

Activity:

Create a draft budget using the 50/30/20 rule and track all your spending for one week.

—

Lesson 1.4 — Tracking and Adjusting

Your first budget won’t be perfect—and that’s okay.

Track, review, and adjust monthly. The goal is awareness, not perfection.

Tips:

Use tools like Mint, YNAB, or a simple spreadsheet.

Set up reminders to review your finances weekly.

Celebrate small wins—consistency is key.

—

End-of-Week Assignment

1. Write your personal financial “why.”

2. Create one short-term and one long-term SMART financial goal.

3. Draft your first monthly budget.

4. Reflect: What surprised you most about your spending?

Leave a reply to Hazel Cancel reply